Bond Mason Review: Key Investor Statistics

BondMason is offering retail and institutional investors access to the P2P market through a managed portfolio.

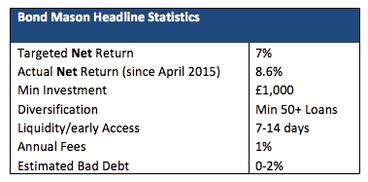

BondMason’s targeted return of 7% appears appealing, particularly since they are outperforming their targets with a past performance of 8.6%, since April 2015. Although BondMason favour asset-backed P2P investments they do invest across a mixture of borrower types, including: consumer, business and property.

How does investing in BondMason work?

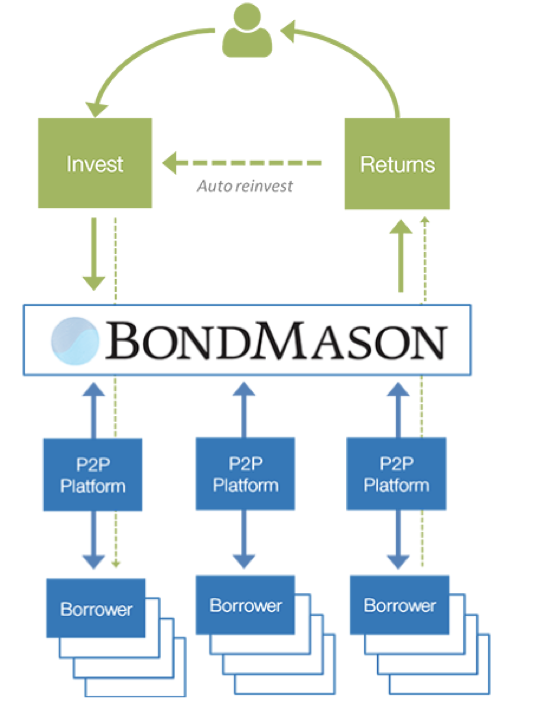

Simply put, after depositing funds into a BondMason account the investor must entrust the BondMason management team to invest their funds across a number of P2P investment opportunities. The diagram below provides an overview of how BondMason operate:

It is important to note that the underlying assets are the same whether investing directly through a P2P platform or through BondMason. It is the loan selection process which differs.

Benefits of investing through BondMason

Due Diligence: If conducting investment due diligence is daunting, investors would be advised to employ professionals. Stephen Findlay, CEO of Bond Mason, commented that they undertake a strict due diligence process. ‘We approve 1 out of 3 platforms and 1 out of 3 loan opportunities within the P2P platform. Investor funds are diversified across a minimum of 50 loans.’

7% Targeted Returns: BondMason targets a reasonable 7% net return. This is net of a 1% annual fee and a 0-2% bad debt estimate.

Double Diversification: Investors in P2P are commonly recommended to diversify across a number of loans within a platform, however, it is less commonly highlighted that investing across a number of peer-to-peer lending platforms also adds to diversification. By investing through BondMason investors are able to diversify their funds across a number of P2P platforms and across a number of loans within the P2P platforms. This is called double diversification.

Reduced Cash Drag: Cash drag is a consideration that is often overlooked when investing in P2P. Cash drag is created when funds sit in an investor’s account earning no interest, waiting to be lent out. This generally happens when there is too much investor capital on a P2P platform for the level of borrowers on the platform. This is a common occurrence on platforms such as Zopa, particularly around the end of the tax year when more investors come onto the platform wanting to invest. BondMason reduces the effects of cash drag by investing their own capital in loans prior to these loans being made available on the BondMason platform.

What are the risks?

In addition to the common risks associated with investing in P2P there is one principal risk associated with investing through BondMason that should be considered.

When referring to the peer-to-peer lending industry as a whole, Cormac Leech, a P2P analyst at Liberum Investment Bank recently stated:

“Fraud risk is the biggest issue because you basically have to trust the management that they're doing what they say they are"

The same is true for investing in BondMason. The principal risk is that the BondMason team make bad investment decisions. For investors it is therefore important that they have faith in Stephen Findlay and the BondMason team to invest funds as they say they will. This leads to questions around the composition of the BondMason team. On the BondMason website it states that Stephen Findlay and his seven-person team have over 50 years' combined investing experience. Taking a further look into the CV of Stephen, he has gained an impressive career as both an entrepreneur and Wealth Manager, notably holding key positions at Fidelity.

Possibly not a risk, but more of an annoyance, is that investors are unable to see the underlying loans or P2P platforms which BondMason invests in prior to depositing the min deposit of £1000. For some investors it would be comforting to see the logos of some of the top platforms which BondMason are dealing with before depositing the £1000.

Conclusion

Asset Management is a logical step for the peer-to-peer lending market and the BondMason proposition appears to be a good one. Targeting above market rates whilst offering investor diversification may be a good option for retail investors. Ultimately, the investor will need to trust that the BondMason team can select loans that deliver the promised 7% targeted return.